The Importance of Money Management: A Guide to Financial Success

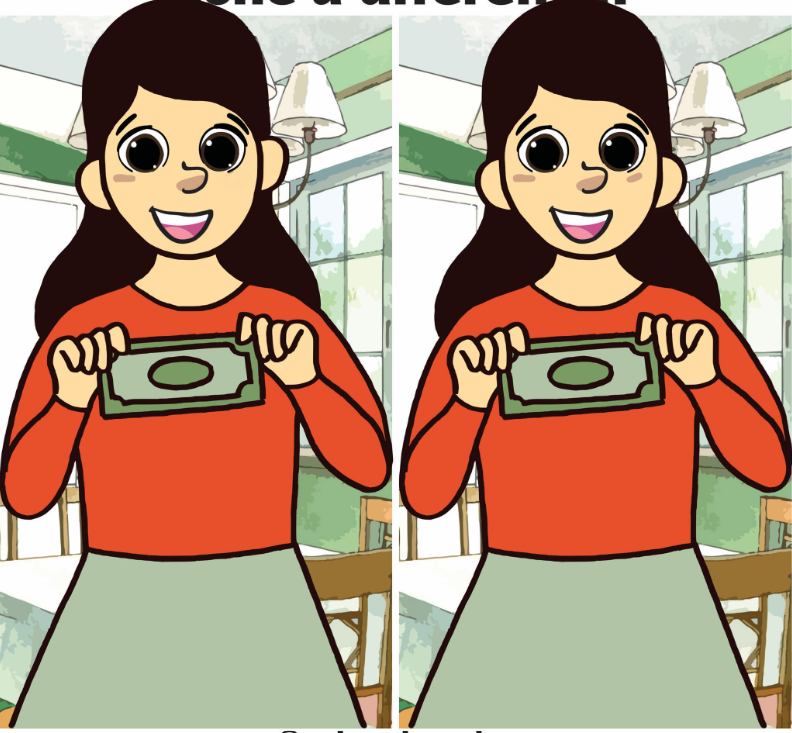

In today’s world, financial literacy is more important than ever. Whether it’s saving, spending wisely, or making sound investment decisions, managing money effectively can significantly impact one’s quality of life. In the image, a young girl is holding a dollar bill with a broad smile, symbolizing the potential and opportunities that come with managing money well. But beyond the smile, there’s much more to understand about how money shapes our lives.

This article will explore why financial literacy matters, how effective money management can lead to financial independence, and the steps you can take to ensure a secure financial future.

Why Money Management is Essential

Money management is not just about budgeting or keeping track of spending—it’s about making informed decisions that will benefit your financial health both now and in the future. Learning how to manage money can be the difference between living paycheck to paycheck or achieving long-term financial goals like buying a home or retirement savings.

- Financial Freedom and Security: Good money management leads to financial freedom. When you’re in control of your finances, you’re less likely to feel stressed about unexpected expenses or debt. Instead, you can focus on building a secure future.

- Better Decision-Making: Knowing how to manage money allows you to make smarter, more informed decisions. You’re more likely to budget effectively, save for future goals, and avoid unnecessary debt.

The young girl in the image looks confident and happy, as she holds the money, symbolizing the positive effects of sound financial management.

The Basics of Money Management

Understanding the basics of money management is the first step towards financial success. If you’re new to managing money or just looking to improve your skills, there are some fundamental practices that can help.

- Budgeting: A budget is a financial plan that helps you track your income and expenses. The goal is to spend less than you earn, and direct any surplus into savings or investments. Use tools like spreadsheets or budgeting apps to stay on track.

- Saving: Setting aside money for emergencies, retirement, and future goals is essential. Ideally, your savings should be at least three to six months’ worth of living expenses in an easily accessible account.

- Debt Management: Understanding how to manage debt responsibly is critical to maintaining good financial health. Avoid high-interest debts like credit card balances and pay down loans systematically.

In the photo, the girl’s positive energy can be compared to someone who has mastered these basics and now reaps the rewards of financial security.

The Role of Smart Spending

Spending wisely is a core component of financial management. While it may seem tempting to make impulse purchases, learning how to control your spending habits will allow you to allocate money more effectively for savings and investments.

- Prioritize Needs Over Wants: It’s easy to get caught up in the desire for the latest gadgets or fashionable clothes. However, distinguishing between needs and wants can help curb unnecessary spending.

- Track Your Spending: Keeping an eye on your expenses can help you identify areas where you can cut back. By tracking where your money goes each month, you can make more mindful choices and redirect funds to your savings or investment accounts.

- Look for Deals: Being smart about shopping doesn’t mean never buying anything. It means looking for discounts, using coupons, and comparing prices before making a purchase.

In the image, the girl holding the dollar bill symbolizes someone who has made a conscious decision to spend wisely, allowing her to make the most of her earnings.

Building a Savings Habit

A significant aspect of money management is developing the habit of saving. It’s not just about saving for a rainy day, but also for life’s big goals like buying a home, traveling, or securing a comfortable retirement.

- Automate Your Savings: One of the easiest ways to save is by setting up automatic transfers from your checking account to your savings account. This removes the temptation to spend the money and ensures you save consistently.

- Set Clear Goals: It’s easier to stay motivated to save when you have a clear goal in mind. Whether it’s saving for an emergency fund, a vacation, or a down payment on a house, knowing what you’re working toward makes saving feel more purposeful.

- Increase Savings Over Time: As your income grows, gradually increase the amount you save. Small increments can have a big impact over time and will help you achieve your goals faster.

In the photo, the smile on the girl’s face represents the joy and satisfaction that comes from having a well-funded savings account.

Investing for the Future

Once you’ve mastered the basics of budgeting, saving, and spending, it’s time to think about growing your wealth through investments. Investing is one of the best ways to build wealth over time and secure your financial future.

- Start Early: The earlier you begin investing, the more you can take advantage of compound interest. Even small investments made early on can grow significantly over time.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversifying your investment portfolio can reduce risk and help you achieve more stable returns.

- Understand Risk: All investments come with some level of risk, so it’s important to understand your risk tolerance. Speak with a financial advisor to find an investment strategy that aligns with your financial goals.

In the image, the girl is holding a bill, signifying the potential to invest and grow wealth. The positive energy she exudes reflects someone who is on the path to financial independence through smart investing.

The Importance of Financial Literacy

Financial literacy is the foundation for everything we’ve discussed. Without a basic understanding of how money works, it’s difficult to make informed decisions about budgeting, saving, spending, or investing. That’s why it’s essential to invest time and effort into improving your financial knowledge.

- Education is Key: The more you know about personal finance, the better equipped you’ll be to make smart decisions. From books and online courses to financial blogs and podcasts, there are countless resources available to help you increase your financial literacy.

- Seek Professional Advice: If you feel overwhelmed by financial matters, it’s always a good idea to seek advice from a financial advisor. They can help you create a personalized financial plan and give you guidance on investing and saving strategies.

In the image, the girl’s smile shows the confidence that comes from understanding the value of money and how to manage it wisely.

Conclusion: Mastering Money Management for a Bright Future

Money management is a skill that everyone can develop, and it’s never too early or too late to start. Whether you’re just beginning your financial journey or looking to improve your current situation, the key is to prioritize saving, spending wisely, and investing for the future. The young girl in the image holding her dollar bill represents the power and potential that comes from making smart financial choices. By following the strategies outlined in this article, you can take control of your financial future and achieve your goals, one step at a time.

In the end, it’s not about how much money you make, but how well you manage it.